How To Optimise Payroll Taxes To Avoid Penalties And Fees?

G’day, mates! Navigating the intricacies of payroll taxes in Australia can be a real challenge, especially with the ever-changing regulations and the looming threat of payroll tax penalties. In this guide, we’ll delve into the nuances of Aussie payroll taxes, providing you with practical tips on how to optimise your approach, stay compliant, and save money while steering clear of the dreaded payroll tax penalties.

What are payroll tax penalties and why should you care?

Payroll tax penalties, mate, are fines slapped on by the government for not playing by the payroll tax rules. They can come from stuff-ups in your reporting, late submissions, or underpayment. As a business owner, caring about these penalties is a fair go, as they can seriously impact your bottom line. Let’s dive into the reasons why steering clear of payroll tax penalties is as important as keeping your tucker safe from drop bears.

- Financial impact: These penalties can hit your wallet harder than a kangaroo’s kick. Understanding the rules and staying on the straight and narrow can free up those funds for business growth.

- Reputation management: Constantly forking out penalties can make your business as popular as a cold VB. Your customers, partners, and workers might start thinking you’re not fair dinkum.

- Legal consequences: Ignoring payroll tax rules could see you in a bind with the law. Being in the crosshairs of the taxman can lead to audits, investigations, and a world of legal hurt.

Who needs to pay payroll taxes?

Understanding who’s gotta pony up for payroll taxes is the real McCoy. In Australia, businesses with annual wages higher than a kangaroo’s jump are generally on the hook. But, fair dinkum, there are exemptions for some industries or situations. It’s crucial to suss out your obligations and eligibility to avoid unnecessary penalties.

Worried about payroll tax penalties? Here’s how to stay compliant and save money

Navigating the payroll tax landscape requires a fair bit of savvy. Here’s a step-by-step guide to help you stay on the sunny side of compliance and save a few bob:

- Stay informed: Keep your ear to the ground with updates on payroll tax rules. Subscribe to newsletters, rock up to seminars, and have a chinwag in industry forums to stay ahead.

- Accurate record-keeping: Keep records of employee wages, deductions, and taxes that are as precise as a GPS on a ute. Cloud-based payroll software can be a ripper for streamlining this process and avoiding any clangers.

- Timely submissions: Ensure that your payroll tax submissions are accurate and submitted on time. Late submissions often result in penalties, so set up reminders and allocate dedicated time for this task.

- Professional advice: Chuck a yarn with tax professionals or advisory services. Their expertise can be the lifesaver you need to navigate these tricky tax waters.

- Regular audits: Keep your business shipshape by conducting regular internal audits. This proactive approach helps you spot any gremlins in the system before they become big problems.

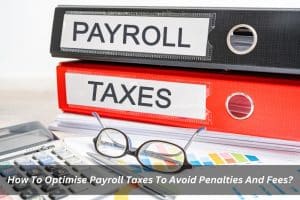

What are you paying for? Understanding different payroll tax types

Payroll taxes come in more varieties than a box of Shapes. These include:

- State payroll tax: Each state has its own tax to fund local infrastructure and services.

- Federal payroll tax: Collected by the Australian Taxation Office (ATO), it kicks in to fund national programs and services.

- Superannuation guarantee (SG): Not exactly a payroll tax, but mandatory nonetheless. It’s like a chock-a-block contribution to employees’ super funds. Messing this up can land you in hot water.

Understanding these different taxes helps you divvy up your resources right and ensures you’re playing by the rules.

How do you calculate payroll taxes?

Calculating payroll taxes involves a bit of arithmetic, but it’s as easy as throwing a snag on the Barbie. Use this simple formula:

PayrollTax=(TotalTaxableWages−Tax−FreeThreshold)×TaxRate

Make it even easier by using payroll software or consulting professionals to automate the process and avoid any hiccups.

Can you avoid payroll taxes altogether?

While dodging payroll taxes entirely might be wishful thinking, there are a few exemptions and deductions to chuck into the mix. Exemptions might apply to certain industries or job types, and deductions can whittle down your taxable wages. Knowing the ins and outs can help you optimise your payroll tax strategy and maybe save a few quid.

Are you making these common mistakes? Avoiding pitfalls that lead to payroll tax penalties

Mate, there are a few traps you should steer clear of to avoid getting stung with payroll tax penalties:

- Misclassifying employees: Make sure you’ve got your employees sorted – casual, part-time, or full-time. Getting this wrong can throw out your calculations.

- Ignoring exemptions: Don’t be a galah – check out the exemptions that might apply to your business. Missing out on these could mean you’re paying more tax than you need to.

- Late payments: Pay your dues on time, mate. Late payments are like a boomerang – they’ll come back and hit you. Set up your payments in advance to avoid any headaches.

How can you streamline payroll tax processes and minimise errors?

Making payroll tax processes as smooth as a Bondi wave is key to dodging errors and staying on the right side of the ATO. Try these strategies:

- Invest in payroll software: Grab yourself some top-notch payroll software to automate the heavy lifting. It’s like having a virtual assistant without the tea breaks.

- Employee training: Make sure your team knows the ropes when it comes to payroll. Training prevents mistakes and ensures everyone’s singing from the same song sheet.

- Outsource payroll services: If it’s all getting a bit much, think about outsourcing your payroll to the pros. It saves time and takes the pressure off your internal crew.

What happens if you incur payroll tax penalties?

Getting slapped with payroll tax penalties is no joke. The consequences include:

- Financial impact: These penalties will cost you more than a round of drinks at the local. It puts a dent in your cash flow and eats into your profits.

- Legal consequences: Ignoring the taxman could land you in court. Audits, investigations, and legal battles are on the cards if you don’t get your act together.

- Reputation damage: Keep copping penalties, and your business reputation will take a hit. Customers, partners, and employees might start looking for a better deal.

Conclusion

Optimising payroll taxes is an ongoing effort that demands a keen eye for detail and sticking to the rules. By staying in the loop, adopting best practices, and calling in the cavalry when needed, you can navigate the payroll tax maze and keep penalties at bay.

At Falcon Advisory, we understand the challenges businesses face in managing their finances and payroll taxes. That’s why we’re here to offer our Virtual CFO services. Our experienced team can provide tailored solutions to streamline your payroll processes, ensure compliance, and help your business thrive. Don’t let payroll tax complexities hinder your success – partner with our experts to take control of your financial strategy today.

To explore how our Virtual CFO services can benefit your business, get in touch with us today for a personalised consultation. Let us be your trusted financial partner on the journey to success. Cheers, and happy tax wrangling!